27 Feb 2020

The term "self storage" is short for self-service storage, sometimes also called mini storage. Self storage facilities lease space to individuals (usually storing household goods), or to small businesses (usually storing excess inventory or archived records). The rented spaces, known as "units," are secured by the tenant's own lock and key and facility operators do not have access to the contents of the space but may provide computer-controlled access to rental space areas. An operator never takes possession, care, custody or control of the contents of the storage rental space unless a lien is imposed as provided in self-storage laws for non-payment of rent. In that event, the property owner would break the unit lock, seize the assets, and usually auction them off to help offset the delinquent rent payments. Many lenders consider self-storage facilities “specialty use” properties since they can only be used for the operation of a self-storage business.

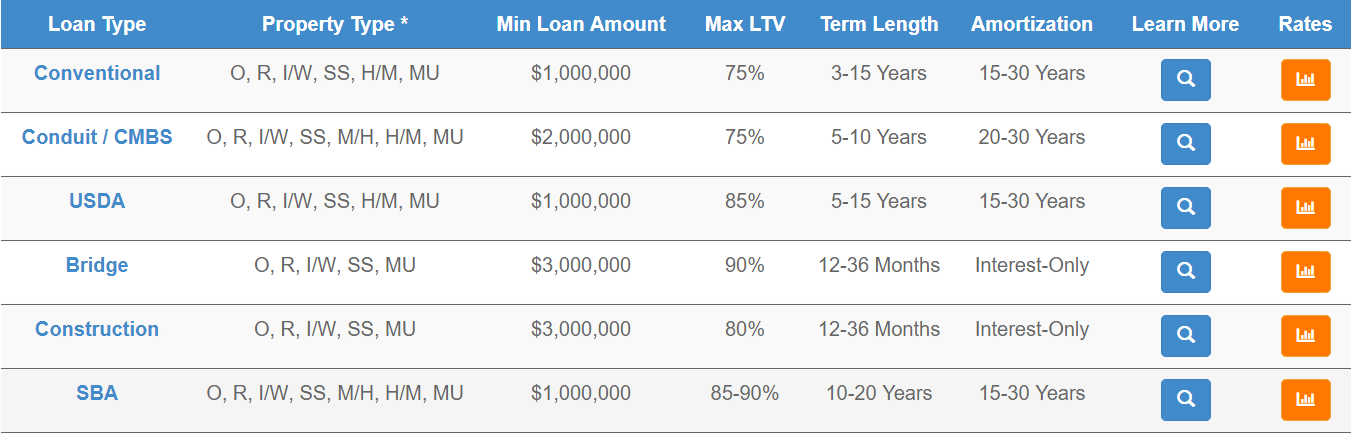

Conventional: Traditional banks/lenders offer conventional loans. These loans typically offer favorable terms like low-interest rates, years-long terms, and high loan amounts. To be eligible for mini-storage conventional loans you will likely need an excellent credit score, a high-performing business, and assets you can put up as collateral.

Conduit/CMBS: Conduit loans are ideal for properties that are not brand new and that have stabilized occupancy. These loans vary from 6.75 percent to 8 percent, and your interest rate is determined by your debt coverage, LTV, and loan size. Most lenders on the conduit market underwrite loans to a max of 75% LTV, and use the previous 12 months of cash flow in their lending decision. Most do not include alternative income sources like income from interest, late fees, and vehicle storage income. Conduit loans generally offer low fixed rates and are categorized as nonrecourse loans. They often have high prepayment penalties which are tied to defeasance/yield maintenance.

USDA: USDA loans are obtained through the United States Department of Agriculture program for rural development. These loans are available for individual investors or companies that are looking to build, refinance or acquire self-storage sites in rural areas. USDA loans can be used for purchases, refinances, construction, and expansion. Loan amounts range from 500k to 10 million dollars, and rates range between Prime + .5% and 2.75%, depending on the borrower's creditworthiness. USDA self-storage loans come in 30-year terms with an LTV between 50% and 90%.

SBA: SBA, or Small Business Administration loans can be utilized to buy, refinance, or expand a mini-storage facility. Financing for mini-storage is available for as much as 90% LTV and 9 million dollars for a purchase or refinance. For ground-up construction or expansion, it is 90% loan to cost. Under SBA, self-storage is considered an owner-occupied property. SBA loan terms go up to 25 years+construction time. They typically have lower down payment and equity requirements. For purchases, expansions, construction or refinances is usually 10%. SBA loans are determined by the total amount of SBA eligibility used, rather than the number of loans, so as long as you are beneath your eligibility limit you can use SBA loans for multiple mini-storage properties.

Lending guidelines differ for recourse and non-recourse loans, i.e. loans that are either secured by collateral like a property, or not secured. The current self-storage lending guidelines are as follows:

Non-Recourse:

Recourse:

Before completing the loan application process you will need to prepare your financial package. This package must include personal financial statements and resumes for any principals on the loan. In addition, it should include the past three years plus the current YTD of property operating statements and rent rolls. For self-storage/mini-storage loans you can find the specific forms you need to fill out here.

Non-Recourse Mortgages:

Recourse Mortgages:

How much does it cost to start a storage facility business?

Like any other business, the startup costs for a storage facility will differ from project to project. While a self-storage facility is simple to start up compared to some other business endeavors, it is still a business and will require a great deal of planning and follow through if you want your facility to become profitable.

Generally speaking, the costs associated with setting up a storage facility include the land on which the facility is to be placed, construction and design costs for the building, government approval fees and permits, as well as operating capital to keep your facility running while you are obtaining clients to rent out your storage units. All of these expenses are dependent on the location you choose, the contractors you hire, and your ability to sell units right out of the gate.

Every self-storage project is unique, and your costs will reflect the nature of your business. Expect to pay for land, construction costs, government fees, and startup expenses before you are up and running.

Is storage a good investment compared to other types of real estate?

Self/mini-storage investments have a number of critical advantages over other RE assets. A recent study conducted by The Parham Group compared failure rates for 4 major real estate asset classes. Retail, multifamily, and office real estate investments reported failure rates between 53 and 63 percent over a 10 year period. Self-storage facilities failed at a rate of 8% over the same timeframe. This study tells us that storage investments tend to remain profitable, or at least break even when compared to other types of real estate investments.

Self storage facilities also have the advantage of sustainable market demand during periods of economic growth as well as during a contraction or recession. When the market is up, many homeowners are more mobile and use storage facilities while they are upgrading their living situation. Commercial tenants will also rent out more space for goods and equipment storage as their businesses expand. During a market downturn, many homeowners and businesses will be looking to downgrade their homes or offices to cope with new economic realities. Many of these people will choose to store their goods at a mini-storage or self storage facility due to the decreased size of their home or commercial space.

The low failure rate of self storage facilities, combined with the fact that they thrive during economic expansions and contractions means they can be excellent assets for your investment portfolio.

Can boat and RV storage be on the same parcel as mini storage?

Yes. Mini-storage/self storage facilities may be located on the same parcel of land as boat and RV storage. While recreational vehicles and boats remain a popular choice for consumers, many lack the necessary room in or around their homes to store these vehicles. Right now, homes and lot size are trending smaller, and ever-larger numbers of the general public are choosing to live in apartment buildings and other higher density living arrangements. This fact presents an opportunity for owner investors to diversify their revenue streams and widening their customer base by offering boat and RV storage on the same parcel as their self storage or mini-storage facility.

Should I buy or build a storage facility?

Before you get involved in the self and mini storage business you have to decide whether you want to buy or build a storage facility. The ideal route for you as an owner-investor is completely situational, and is it possible to work with lenders to fund either option. A storage facility represents a large investment of capital, and many investors like the idea of “steering their own ship.” What better way to ensure that your facility can meet your ROI goals than to build it to your exact specifications? You can use the management systems and technology solutions that work best for your needs.

However, there is a downside to building a brand new facility, aside from the construction costs- that downside is the fact that you will start from zero, rather than inheriting an existing customer base from a purchased self-storage facility. Until you are able to connect with customers, you will be responsible for paying overhead as well as construction costs out of your own funds. Nothing is guaranteed when it comes to construction. You have government obstacles that can last years, and many investors do not have the time or patience to go through that process.

When you purchase an existing facility you avoid many of these snafus but lose the ability to “steer your own ship.” The path you take depends on your individual needs and capabilities as a self storage investor.

Photo by Tembela Bohle from Pexels