27 May 2020

The following quote, from a recent article published by Eater.com, may be a prediction of what is coming for sit-down Restaurants in the US:

“Masked waiters, half-empty dining rooms, and mobile ordering may all be part of the new reality when restaurants open their doors again.”

The impact of the pandemic on commercial real estate is just starting to take shape and it’s clear that some asset classes and businesses will be hit harder than others. The self storage sector has experienced explosive growth and good performance over the past decade, and, like many, it is likely to face some challenges ahead.

On April 15, 2020, the Fannie Mae Economic and Strategic Research Group (ESR) sent out a press release saying they expect the economy to be in recession in 2020 and then rebound in 2021.

“With consumers staying home, many businesses shutting, and household financial stress growing, the ESR Group now projects back-to-back quarters of negative real GDP growth in the first half of 2020, meeting the commonly accepted definition of a recession.”

External forces have always been influencers of dramatic market movement and the pandemic is no different in this regard. Those of us who are veteran commercial real estate analysts have experienced substantial fluctuations in markets over the years. In the 1980’s, we reviewed portfolios of failed self storage projects for the Resolution Trust Corporation (RTC), and in the 1990’s, we felt the pains of recession with lower bank valuations and a drop in new development. The financial crisis in the mid-2000’s dealt a crippling blow to liquidity and funding as well. All of these events can generally be summed up as “real estate cycles” with boom and bust periods. A real estate cycle is more dynamic with a variety of variables, but when there is a lack of demand that real estate values suffer most.

In the mid-1990’s the supply of self storage in the Midwest was in the range of 3 to 4 rentable square feet per person (RSF) and at that supply level, both supply and demand were in balance. In recent years, self storage construction has exceeded population growth. In 2020, the amount of supply had increased to over 5 to 6 RSF per person on average. On the demand side, self storage has been increasingly embraced by users. The evolution of technology solutions, media exposure, vertical infill retail locations, national brands, and ease of renting have all increased the use and acceptance of self-storage.

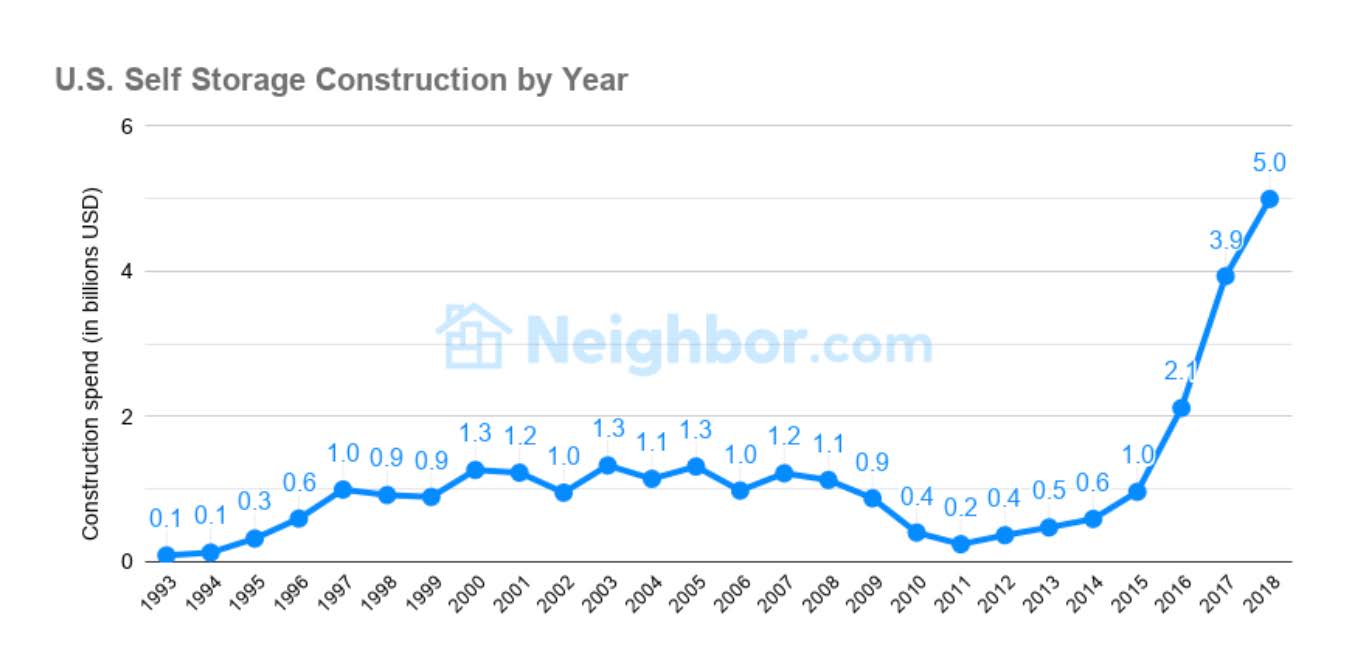

Over the past several years, the booming economy, low interest rate environment, and hunger for safer yields from investors, lead to the biggest investment in new self storage development in history. With over $10 B spent on new self storage construction since 2016, that amount exceeded what was spent in the prior 20-year period as shown.

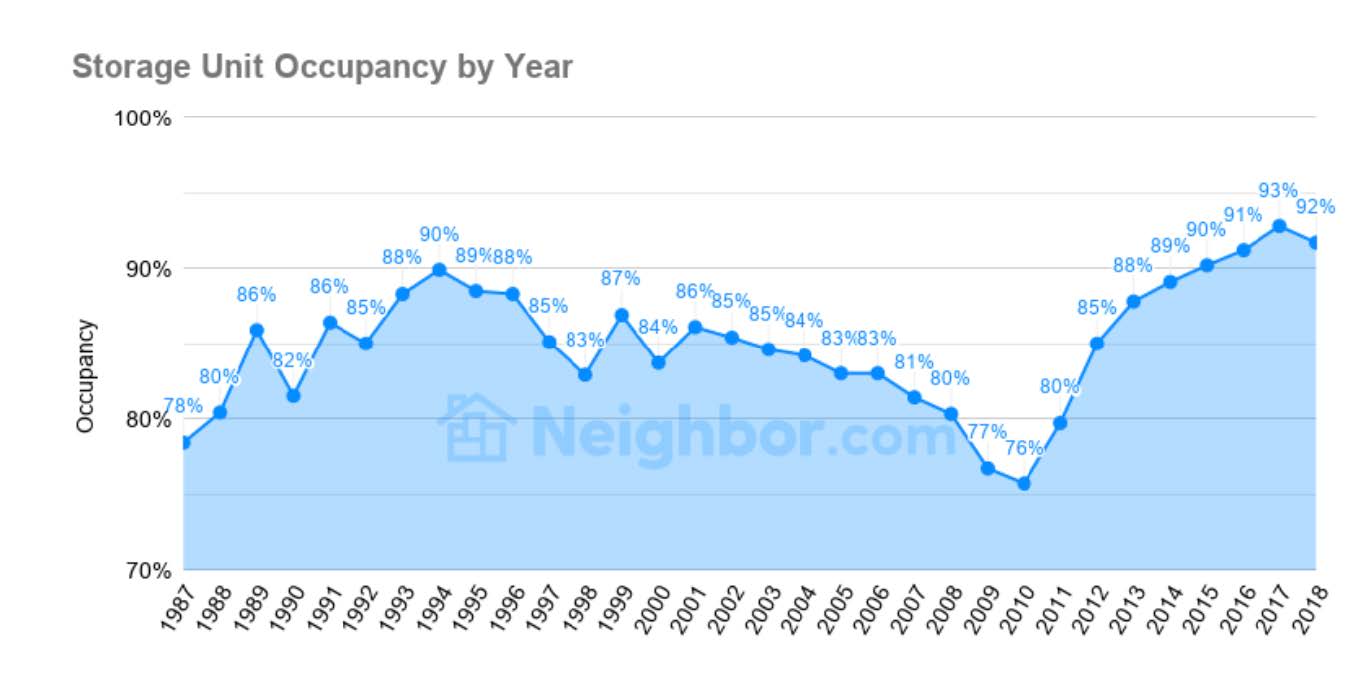

And even with this amount of new self storage development occupancies kept pace remaining above 90 percent as shown.

Up until the pandemic crisis, things had been very good in the self storage market with the expectation of moderate growth and performance in 2020.

After the financial crisis, which was in the 2007 thru 2010 period, the self storage sector has been in a period of high expansion and demand driven by a good economy. The global shut down and lack of an immediate medical solution to the pandemic have caused a great deal of pain across the financial spectrum as well as fear and uncertainty within the populace. The stock market is a real time metric of pricing, and since the crisis, value is down 20 percent. The following is a look at stock pricing for the top Self Storage REIT’s.

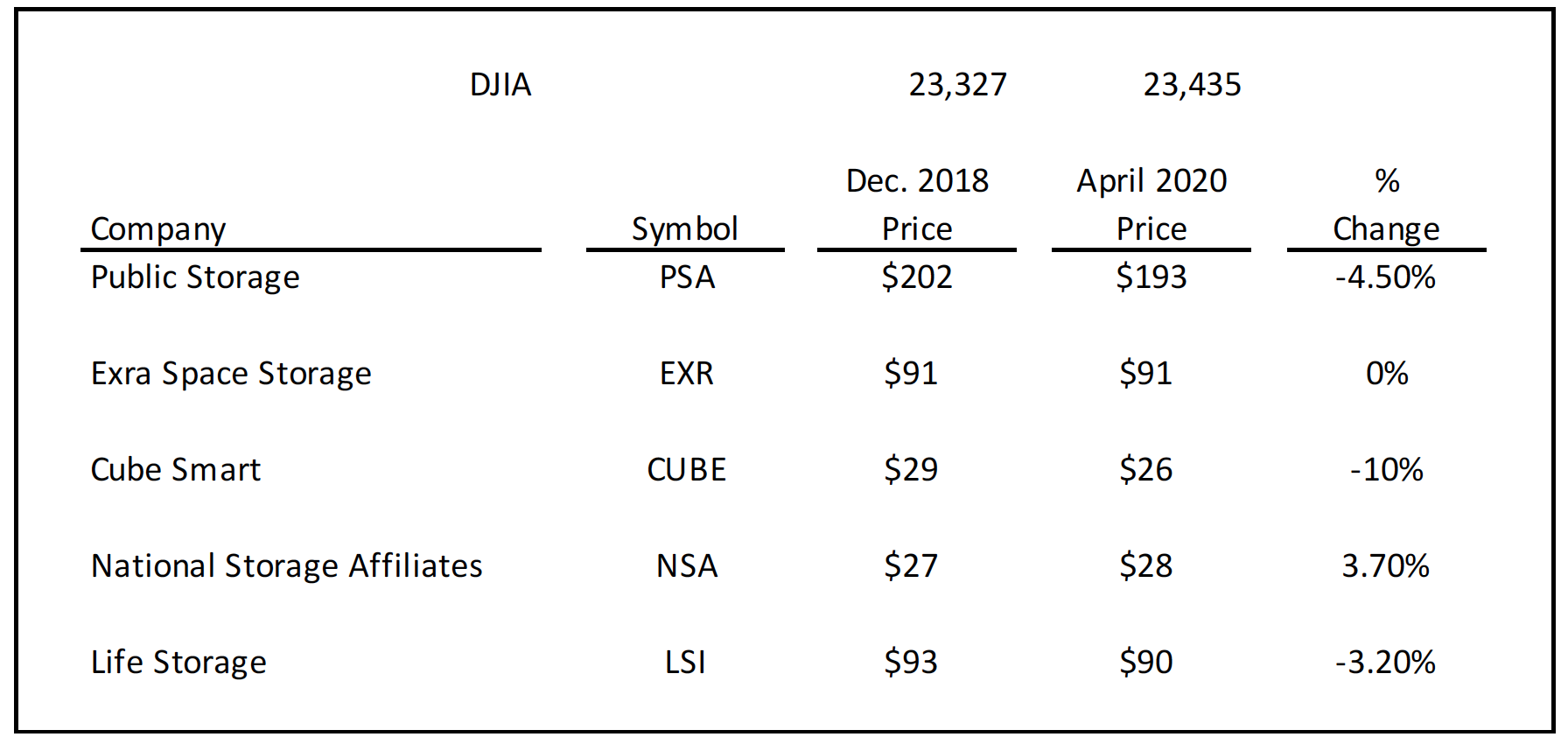

For economic analysis purposes let’s look at the pricing level of stocks when the Dow Jones Industrial Average (DJIA) was at a similar level as of today, which was in December 2018. The following chart summarizes that data.

In December 2018, the DJIA was around 23,327 and in April 2020 it is 23,435. Between 2018 and 2020 the compared pricing of REIT shares has ranged from -4.50% to +3.70% over the period.

These results do not seem too bad considering the state of the country. Granted we are removing the high valuations of 2019, but this view indicates that the sector has stabilizing elements that may be less impacted by the pandemic. And by removing the exuberance of the 2019 market, we have shown that prices/values have softened to near the end of 2018 levels. This is not a bad result compared to equities in other sectors.

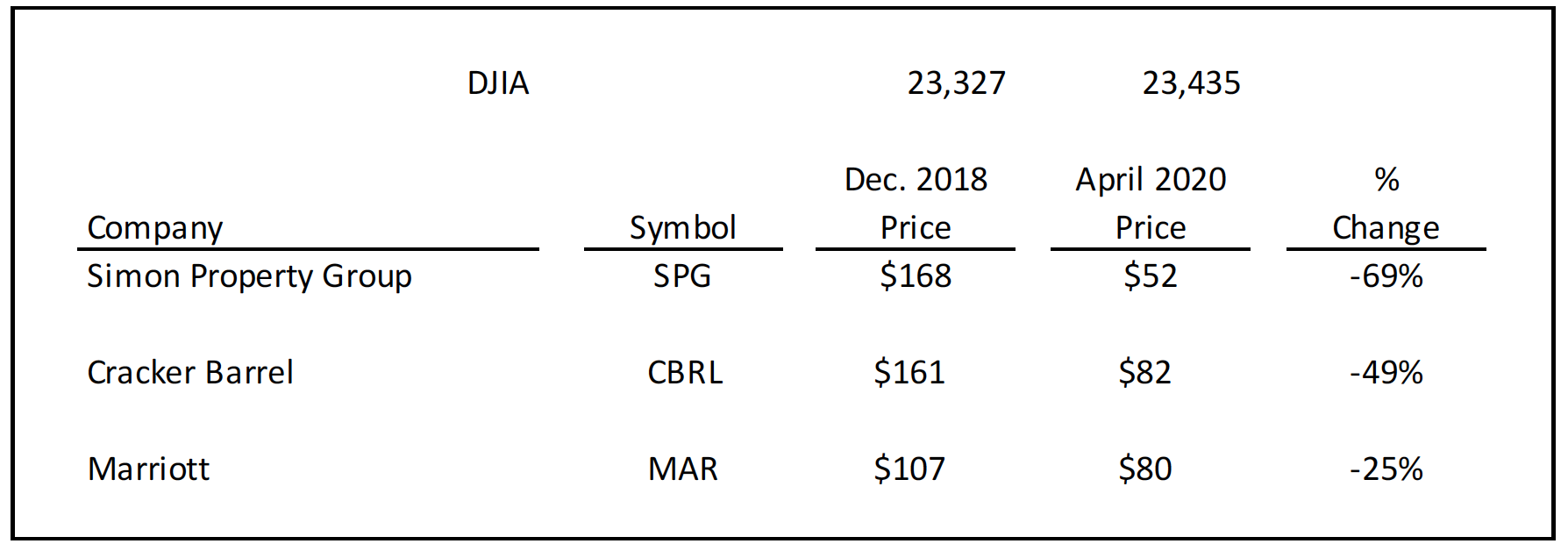

The following shows the pricing and a similar comparison covering some of those companies that have been more heavily impacted by the pandemic.

In this sample the retail, restaurant, and hospitality markets are represented, and the stock prices are down between -25% to -69% for the compared periods.

As self storage has evolved over the past 50 years it has proved itself as a solid real estate investment asset and as a sophisticated solution to customer storage needs. The sector has faced challenges in the past and the current pandemic brings new pressures, but the sector will do much better than many others over the next 18 months.

Thumbnail: Photo by Ricardo Esquivel from Pexels