06 Nov 2023

The idea that “vacancy is good” seems counterintuitive. Some operators believe that the path to maximum revenue is to keep every unit occupied. If a tenant moves out, fill that unit as quickly as possible. With occupancy at 100%, you have reached maximum revenue. But the reality is, the rates you charge matter just as much as your occupancy.

Here’s a thought experiment: would you rather have 100 10x10s filled at $90 each or 85 filled at $110 each? If you’re a red-blooded American capitalist, you’d probably prefer to leave 15 units vacant and get the higher $110 rate, leaving you with $350 extra in your pocket. That is the kind of trade off you need to consider when you set your street rates.

Self storage operators often fear pricing units too high and missing out on potential tenants. However, there is a cost of pricing units too low: it is your customers “willingness to pay”. In theory, every customer has a maximum rate that they are willing to pay. Oftentimes customers are willing to pay more than the street rate, but are grateful you only charge what you do. You never really know the price an individual customer is willing to pay, but by taking a data-driven, dynamic pricing approach to revenue management, you can move street rates closer to your customer’s maximum willingness to pay.

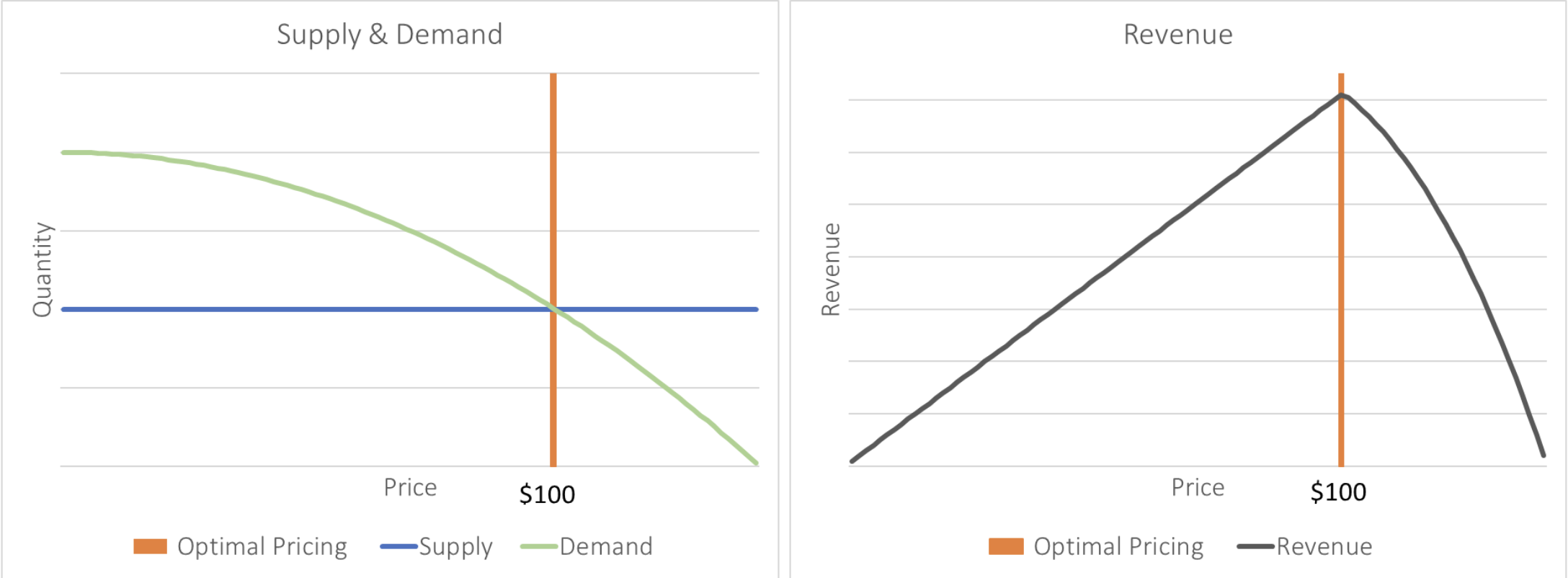

A brief pause for an Econ 101 supply and demand recap. Here is a sample supply and demand curve for a facility with 50 10x10 units:

Let’s assume that the optimal price for these 50 10x10s is $100. When pricing is lower than optimal, say at $80, demand exceeds supply. So many customers in your market would love to have a 10x10 for $80 that there is more demand than you have supply of 10x10s, and you easily hit 100% occupancy. Some customers would be willing to pay more than $80, but are very happy only paying $80.

When pricing is higher than optimal, say $120, the demand curve drops off sharply and far fewer customers are willing to pay $120, leaving many 10x10 units vacant. There is always an optimal price that results in maximum revenue. Given that your supply of 10x10s is fixed, it is market demand that should dictate pricing. But how do you measure market demand?

The best data to understand market demand is your competitor’s rates. If there are 10 competitors in a 3-mile radius, your occupancy is only a fraction of the larger market occupancy. While you don’t know your competitor’s occupancy, their rates often track to occupancy- high rates when occupancy is strong, low rates when occupancy is weak.

But not all competitors are equal. Only track street rates for similar competitors in your market. For example, if you have a four-story class A climate-controlled facility, then the Gen 1, cement block, unpaved facility down the street is not a competitor. They are offering a completely different product and their rates are therefore irrelevant. Find competitors that are of similar quality, curb appeal, access, and visibility to track competitor rates.

Next, determine your appropriate target occupancy and move your rates relative to your target occupancy. For example, if you believe occupancy should be at 90% and you are at 85%, decrease your rates relative to your competitors until you reach your target occupancy. Similarly, if you are at 95%, charge a premium to your competitors so you capture the customers with the highest “willingness to pay”. You should require a premium rate for your last available units, only capturing tenants willing to pay a premium. As an added bonus, these customers are likely less price sensitive and therefore less likely to move out due to a rate increase.

Don’t be afraid to have dramatic swings in your street rate pricing, upwards of 30% are normal. For example, if a competitors’ 10x10 rates average $100 and you are well below your target occupancy, start your pricing at $70 to speed up move-in velocity. Remember, rate increases are a part of the self- storage business. Almost all operators institute rate increases at least once per year, oftentimes more. So, if you can capture a tenant at $70 when the market is at $100, you can give them a healthy rate increase quickly, without a cheaper option in the market.

As you capture move-ins and track to your target occupancy, you can incrementally increase your rate until you are back to target occupancy. Pricing matters and you can steal potential customers from your competitors with aggressive and highly dynamic pricing.

Instead of chasing 100% occupancy, chase a target occupancy: lower rates when you are below your target occupancy, higher rates when you are above your target occupancy. While it may be tempting to try and fill every unit, try to capture a customer’s maximum willingness to pay and you will find yourself with higher revenue.

Casey McGrath is the Director of Revenue Management and Marketing at SpareBox Storage, a 109-facility remote management storage operator. To reach him, please email Casey at casey@spareboxstorage.com.