06 Dec 2022

With the Inflation Reduction Act of 2022 (IRA) now signed into law, it aims to make historical climate and clean energy investments that could cut U.S. greenhouse gas (GHG) emissions up to 43% by 2030. Because buildings are one of the largest sources of GHG emissions, increasing energy efficiency projects and accelerating building performance has become more urgent. The IRA includes more than $200 billion in tax incentives designed to do just that and will impact the real estate and construction industry. Those businesses and REITs looking to capitalize on these benefits can further align with environmental, social, and governance (ESG)-focused business strategies.

The 179D commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems in facilities associated with energy-efficiency improvements, including interior lighting systems and HVAC. The recent IRA dramatically increases this deduction, making it impactful for architecture, engineering, and construction (AEC) industries and commercial building owners. It also extended eligibility for Real Estate Investment Trusts (REITs) and tax-exempt entities, including non-profits, hospitals, schools, and tribal properties. Those nontaxable entities pass the deduction on to the primary designers of the properties, including engineers, architects, contractors, energy services providers, and environmental consultants.

To qualify, newly constructed or retrofitted buildings must have system improvements that reduce energy, such as interior lighting (not exterior), building envelope (roof/windows), HVAC, and hot water systems.

Efficient systems must reduce energy costs by 50% or more compared to the ASHRAE Standard 90.1 requirements.

Eligible building owners and designers of government buildings can deduct up to $1.80 per square foot.

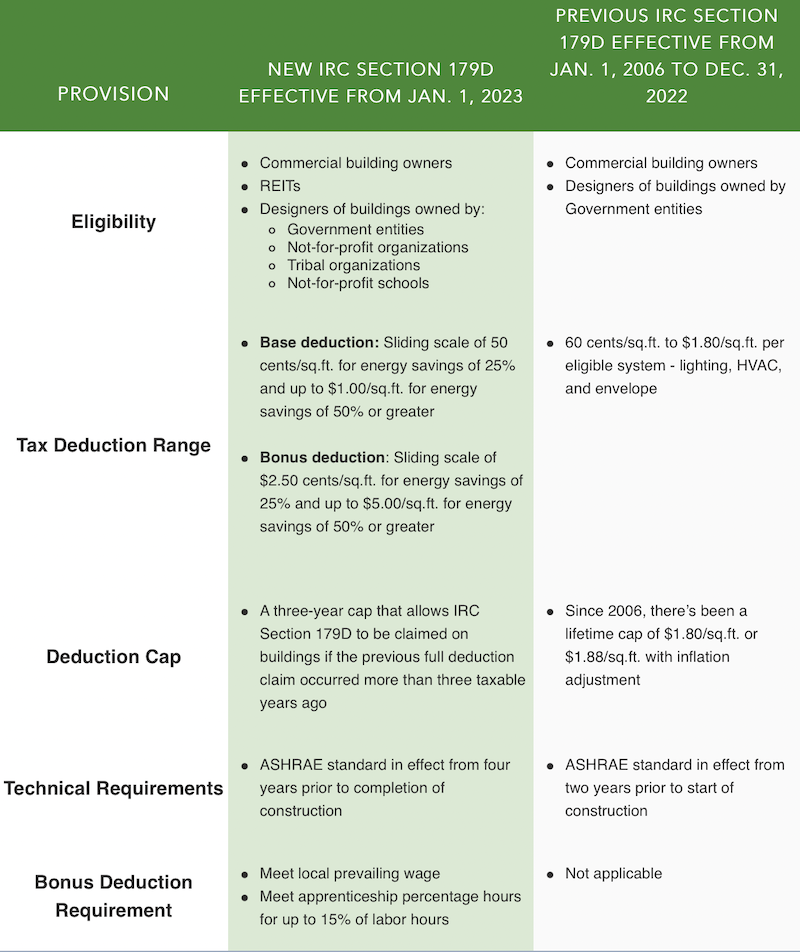

The IRA modifies and expands the Energy Efficient Commercial Buildings Deduction under IRC Section 179D starting January 1, 2023, with the following changes:

The required amount of increased efficiency a building must achieve to qualify for the deduction is reduced from 50% to 25%.

The energy efficiency standard was updated to adhere to ASHRAE 90.1-2007 and will keep current with future ASHRAE standards.

Energy reduction will be based on a whole-building analysis rather than equipment- or system-specific improvements (eliminating partial allowance provision per system).

The base amount of the deduction is 50 cents per square foot, and the deduction is increased by 2 cents for each percentage point in energy efficiency, up to $1 per square foot. A bonus deduction of $2.50 per square foot (base credit multiplied by five) is available if prevailing wage and apprenticeship requirements for laborers and mechanics employed by the taxpayer or contractors associated with the installation are met. The deduction also can be increased by 10 cents for each percentage point increase in energy efficiency, up to $5 per square foot.

Real estate investment trusts can apply 179D deductions against earnings and profits.

A taxpayer cannot prepare the 179D claim on their own and must have a licensed engineer complete a third-party certification to validate the savings claimed on behalf of the owner. In addition, as part of the IRA, the IRS will gain an additional $80 billion of funding, with much of that going toward enforcing compliance amid the changing tax code. Therefore, it is highly recommended that organizations work with a qualified engineering firm and specialty tax professional to complete a Section 179D study and how it applies.

To file an IRC Section 179D claim, the IRS requires:

Inspection, verification, and certification per Section 179D of the Internal Revenue Code by an engineer or contractor licensed in the state where the building is located and not related to the taxpayer.

Energy modeling with Department of Energy-approved software.

Allocation letter (public buildings only).

This new legislation is laying the groundwork for more efficiently performing buildings and is a tipping point for energy efficiency projects focused on sustainability. Furthermore, it should result in substantial growth in technologies that generate improved performance, like interior lighting systems, HVAC, and related controls. If your organization is looking to implement new LED lighting systems to capitalize on these tax credits and other utility rebates, the US LED lighting professionals are available to discuss your project or national program rollout with you. Click here to contact the team.

Sources

https://www.congress.gov/bill/117th-congress/house-bill/5376/text

https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions

https://www.energy.gov/eere/buildings/179d-commercial-buildings-energy-efficiency-tax-deduction

https://www.irs.gov/pub/irs-utl/irc-179d-energy-efficient.pdf

https://taxfoundation.org/inflation-reduction-act-irs-funding/

Get more information at www.usled.com

Norman Kirby is the Director of Marketing for US LED, a full-service provider of LED lighting and turnkey installation for self-storage facilities throughout the United States since 2001. Thanks to decades of engineering expertise, US LED continuously offers ultra-long-life lighting that approaches or exceeds 200,000-Hour L70 lifetimes, backed by an industry-leading Ten-Year Warranty. Additionally, much of the product portfolio is assembled in Houston, Texas. For more information, email inquiries at customerservice@usled.com or contact Norman at nkirby@usled.com.