03 Mar 2020

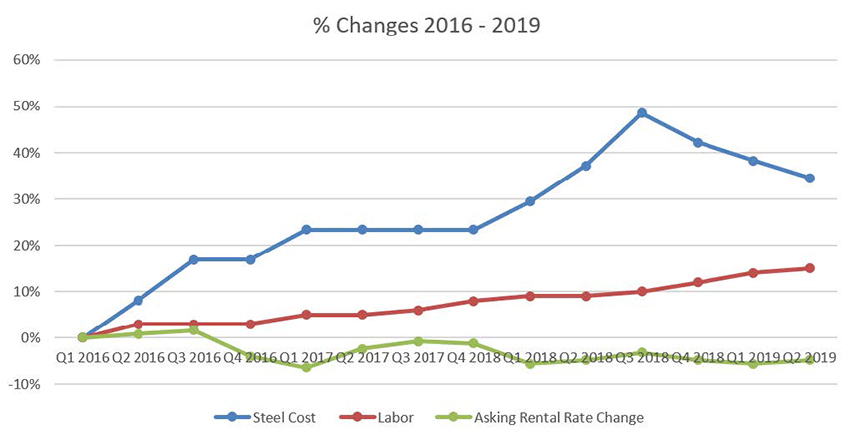

Multiple factors have driven up the cost to build new self storage facilities (see chart below) including the cost of materials (steel prices have increased by as much as 48.5%), labor cost (15%) and land cost (depending on location could be 200-300% or more). Besides the typical cost to build many developers are choosing to build on ever more challenging sites. Historically a developer would find a flat 3 - 5 acre site and build a 40,000 - 60,000 square foot single story facility with mostly drive-up units. Today’s facilities are 60,000 – 150,000 square feet with sophisticated climate control and security features built on sites that can be an acre or less and are three or more floors in height. According to Robert Stacks with RDS Construction based in Lakeside California over 30% of his recent projects also include below-grade units to maximize the net rentable square footage of a project, adding additional costs and complexity to new projects.

Coupled with the incremental costs to build a modern self storage facility is a softening rental rate market with average asking rents dropping 0.9% nationally for May 2019 versus 2018.

These economic challenges are forcing developers to take a more cautious and targeted approach to site selection and pushing developers into secondary or even tertiary markets to find their next site.

The biggest risk developer’s face in the short-term is oversupply in a submarket. Multiple projects being completed in a submarket within months of each other forces facility operators to offer additional rent concessions and rental rates significantly below underwritten rates until each of these facilities achieves stabilized occupancy rates. This supply imbalance can push a facilities time to reach full economic occupancy and market income levels out to year three, four or beyond.